44+ home mortgage interest deduction limitation

Web For the 2020 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct the interest paid on up to 750000 in mortgage. Can I Write-Off My Vehicle.

Saga Book Of The Viking Club Viking Society Web Publications

Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations.

. Ad Calculate Your Payment with 0 Down. Homeowners who bought houses before. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. If the taxpayers mortgage interest deduction must be limited due to the amount or nature of the loans enter the mortgage information in. Web Home Mortgage Interest Limitations.

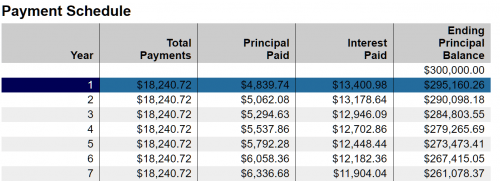

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The average rate for refinancing a 30-year fixed mortgage is currently 705 according to Bankrate. Enter only one 1098 using your average mortgage.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. The rate on a 30-year fixed refinance decreased today. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web The federal standard deduction is high enough that youre unlikely to claim the mortgage interest deduction unless you earn a significant income. Two major provisions in the federal tax code have been limited since the Tax Cuts and Jobs Act TCJA of 2017.

Ask a Verified Tax Expert for Reliable Info Right Now. Web 9 hours agoMortgage pain for 14 million homeowners as costs to rise by 250 per month Experts are warning that the Bank of Englands decision to consecutively raise interest. If you do claim.

Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Web Improving Lives Through Smart Tax Policy. 16 2017 then its tax-deductible on mortgages.

Web The IRS allows you to use the Average Mortgage Balance in determining your mortgage interest deductibility. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Mortgage Interest Deduction Faqs Jeremy Kisner

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Chattel Mortgage What Are Chattel Mortgages Used For With Its Types

Mortgage Interest Deduction Faqs Jeremy Kisner

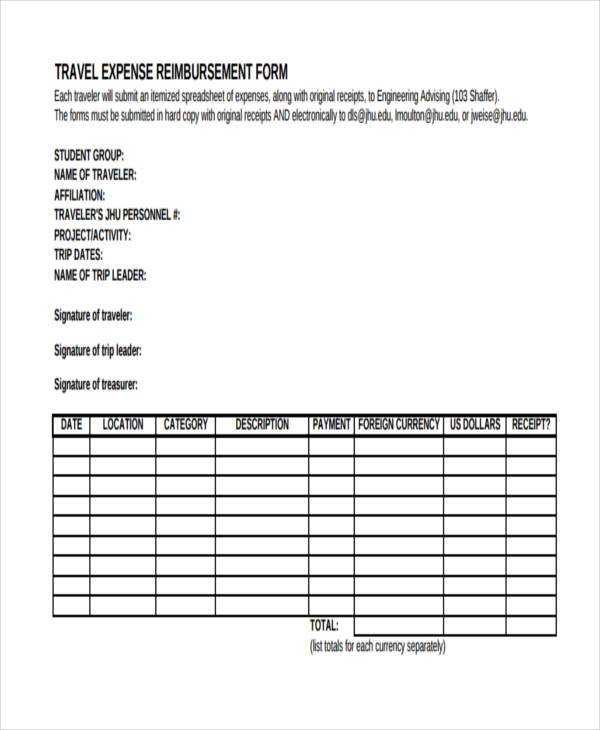

Free 44 Expense Forms In Pdf Ms Word Excel

Mortgage Interest Deduction Or Standard Deduction Houselogic

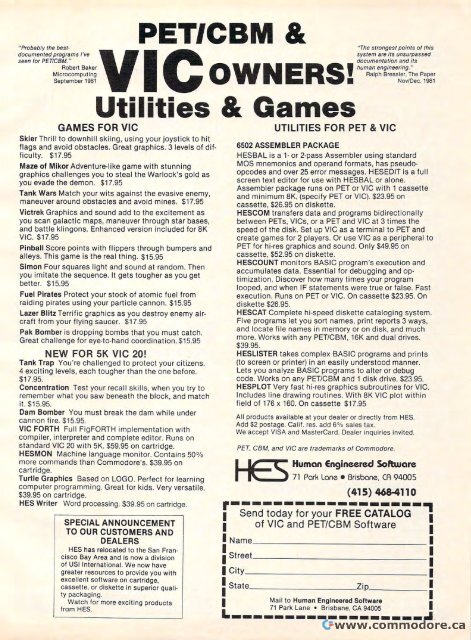

Section 2 Commodore Computers

Mortgage Interest Deduction Cap Is It That Big A Deal Credit Karma

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Maximum Mortgage Tax Deduction Benefit Depends On Income

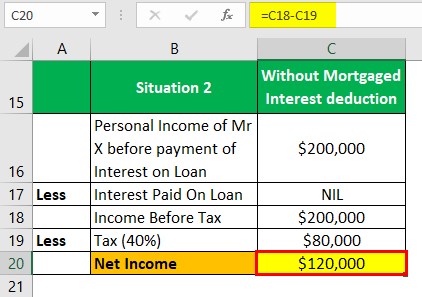

Mortgage Interest Deduction How It Calculate Tax Savings

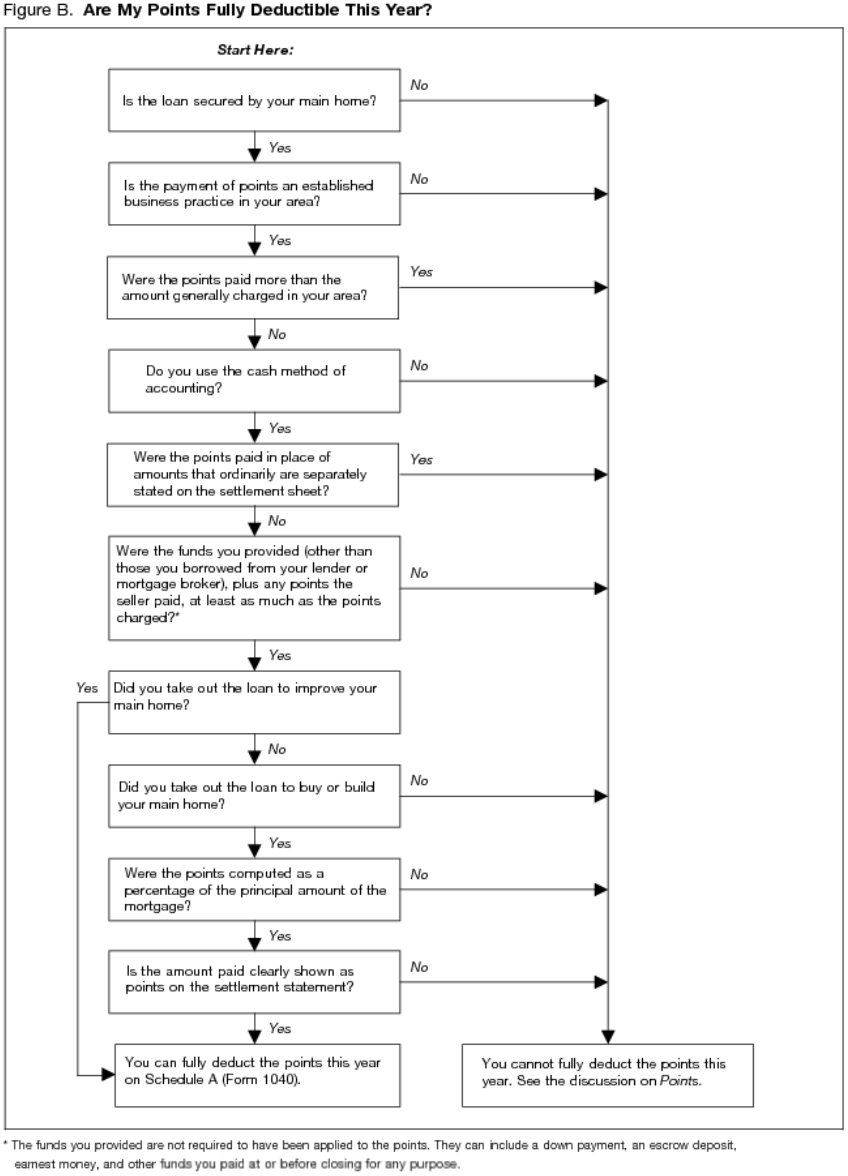

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Pdf The Influence Of Capital Requirement Of Basel Iii Adoption On Banks Operating Efficiency Evidence From U S Banks

Financial Risk Types And Example Of Financial Risk With Advantages